James O'Brien 10am - 1pm

21 December 2023, 00:05 | Updated: 21 December 2023, 00:49

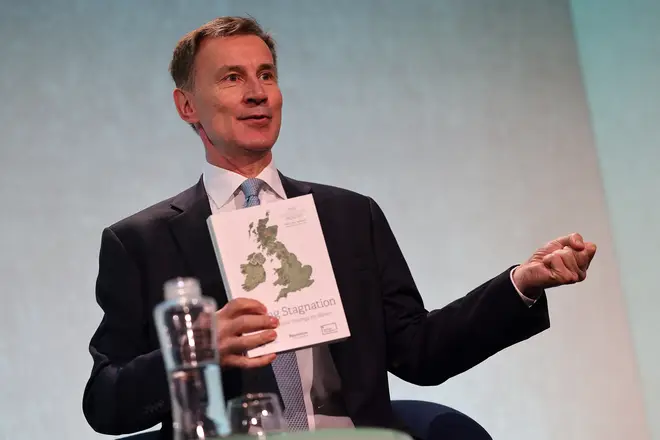

A buoyant Jeremy Hunt has declared that the economy is "back on a path to healthy growth" following a larger-than-expected drop in inflation - which is set to bring mortgage relief for millions.

The cost of a five-year fixed-term mortgage has now fallen below four per cent for the first time in several months and even more drops are expected next year, experts say.

Inflation has fallen to 3.9%, a bigger than expected drop and a large fall from the previous figure of 4.6%, pushing down the cost of borrowing.

There is growing pressure on the Bank of England to cut interest rates as inflation reaches its lowest level in two years, with Work and Pensions Secretary Mel Stride telling LBC that the economy had 'turned a corner'.

Meanwhile, the Chancellor said on Wednesday: “When we can, we want to bring down the tax burden so that people keep more of the money that they earn."

Analysts predict that interest rates, currently set by the BoE at 5.25%, could be cut as soon as February, dropping to around four percent by 2025.

Read More: Average two-year mortgage rate dips below 6% for first time in nearly six months

Mortgage rate cuts will benefit future homebuyers and 1.6 million homeowners planned to come off fixed-rate deals in 2024.

The majority of homeowners have had their fixed mortgage rates set below 2.5 percent.

Following the fall in inflation, Generation Home released a 3.94 per cent five-year fixed deal yesterday, with other lenders expected to take similar moves.

Mel Stride on inflation

Meanwhile, the Government could have a £15 billion boost as the cost of borrowing falls, giving Chancellor Jeremy Hunt more to work with in the Spring budget, The Times reports.

Millions of Brits will already benefit from a cut to National Insurance January, which was announced in the Autumn Statement, though the tax burden is still set to rise to its highest level since World War 2.